FS News

Trump, Tariffs & Tantrums

Posted: 04-04-2025

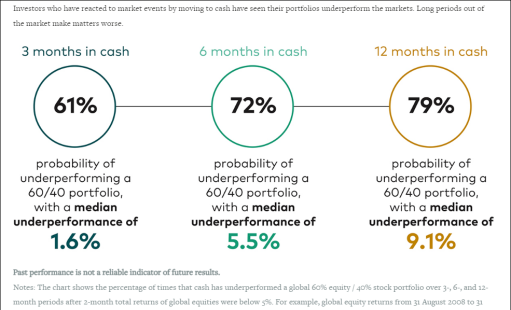

Five years ago this month, we were all in lockdown and had just seen global markets plummet as a result of Covid-19. Our message then was “keep calm, don’t panic, markets will recover”. This certainly proved to the case as...

Pension Update - Post Budget

Posted: 01-11-2024

Despite a number of rumours circulating pre-budget about the possibility of Tax free lump sums being either removed or restricted, no changes were implemented.

Despite rumours that income tax relief for higher earners could be reduced or a “flat-rate” of tax...

Elections & Markets

Posted: 02-07-2024

As the country heads to the polls on Thursday, a question we have been asked a lot in the last few weeks is “What will a change of government mean for my portfolio?”

Whilst we will have to wait until Friday...

2023 - Market Update

Posted: 13-07-2023

2022 was a very tough year for markets as global inflation rocketed which meant that the world’s central banks, such as the Bank of England and the Federal Reserve in the US, had to push up interest rates to try...

2023 – Goodbye Bear, Hello Bull?

Posted: 13-01-2023

From an investment perspective 2022 was a tough year. Global markets fell in January and spent the rest of the year in negative territory against the backdrop of higher inflation, the war in Ukraine and a cost of living crisis.

With...

Market Volatility Update

Posted: 29-09-2022

2022 continues to be a very eventful year and stock market volatility increased this week after the “Mini Budget” which forced a Bank of England intervention in gilt markets and a warning from the International Monetary Fund (IMF).

The outlook for...