2023 - Market Update

2022 was a very tough year for markets as global inflation rocketed which meant that the world’s central banks, such as the Bank of England and the Federal Reserve in the US, had to push up interest rates to try and tackle the issue. We are now halfway through 2023 and the same issues are persisting.

Higher interest rates are good news for cash savers, but bad news for individuals or companies who have debt and are also generally bad news for the stock market.

It was hoped that as we headed into 2023 that inflation could be brought under control and therefore interest rates would start to come down. Markets began the year well with the FTSE 100 up nearly 8% by April. However, inflation has proved “stickier” than was expected, particularly in the UK which has the highest inflation of any major global economy. The FTSE is now negative for the year and anyone who has a pension or investment has seen their values fall.

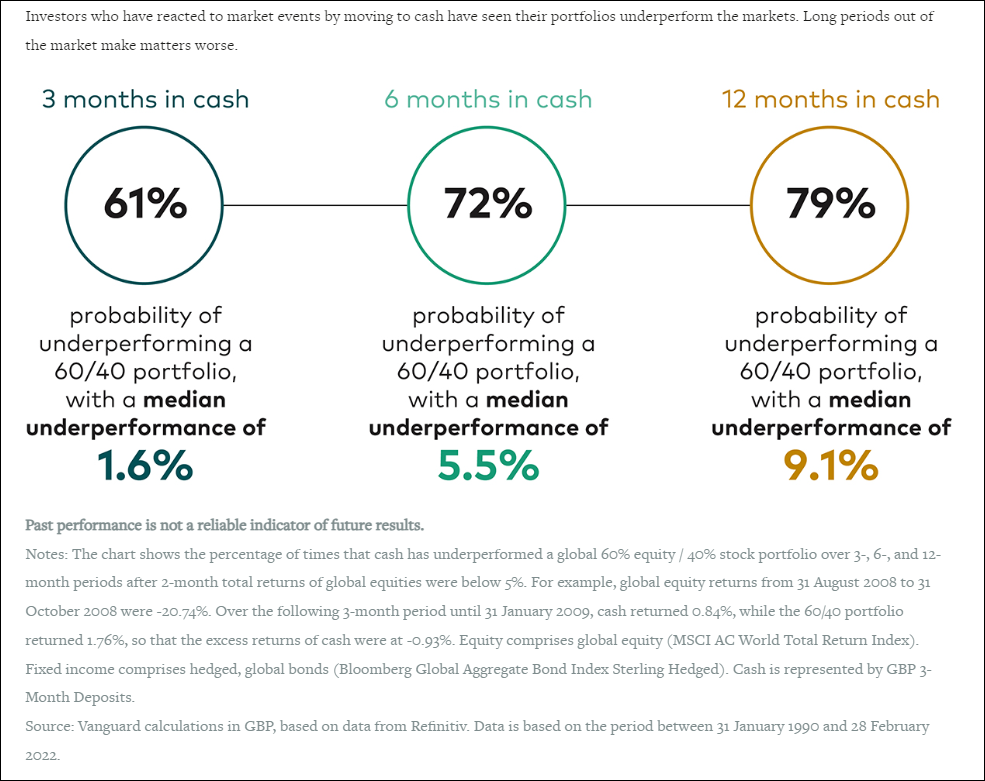

This continues a very frustrating time for investors as we are now 18 months into a period of heightened volatility and falling investment values. In times like this it can be very tempting to lose faith in investing and consider moving money out of the market or stopping regular investments, particularly when attractive rates are on offer from online savings accounts.

However, in our view, unless your circumstances have changed, this could be a costly mistake. Each month that passes gets us closer to the point when the outlook improves, and markets change direction. Some of the best days in the market occur when least expected and you will only benefit from these if you remain invested. (See the chart below from Vanguard which shows the impact of being out of the market and missing these days).

Vanguard - Don’t Panic during Market Turmoil:

You are always rewarded for patience and taking the longer-term view. As the great Warren Buffett said: “The stock market is a device to transfer money from the impatient to the patient”.

Volatility is, and always has been, part of the journey when investing but history tells us that every bear market is followed by a bull market, which tends to last a lot longer.

Interest rates will not stay at these heightened levels, and whilst they are unlikely to return to the very low rates we have seen for the last 15 years, they will come down. By this time share prices are likely to be higher, so trying to time an exit and re-entry into the market is almost impossible.

So the message remains – sit tight and try to ignore the noise. Markets and therefore your pension or investment will recover.

As ever, we are here to help so if you would like to speak to your adviser, please do not hesitate to get in touch.

Yours sincerely

The Wealth Management Team