Trump, Tariffs & Tantrums

Five years ago this month, we were all in lockdown and had just seen global markets plummet as a result of Covid-19. Our message then was “keep calm, don’t panic, markets will recover”. This certainly proved to the case as markets actually ended the year higher than they started.

Five years on, we face another challenge confronting global markets, this time from a much more visible protagonist. The recent announcements regarding tariffs from President Trump on "Liberation Day" have indeed caused significant turmoil in global stock markets.

Whilst our overriding message remains the same as five years ago, we thought it would useful to share some of the key implications for global trade and the future direction of markets.

Implications for Global Trade and Markets:

• Increased volatility in the short term: The immediate reaction to the tariffs has been a sell-off in stock markets worldwide.

• Inflation may rise: The tariffs could lead to higher prices for imported goods, contributing to inflation.

• US and global growth may suffer: The US economy, along with other countries, might experience slower growth due to the tariffs.

• Possible retaliation from other countries: Other nations may implement counter-tariffs, further escalating trade tensions.

• Businesses may put spending plans on hold: Uncertainty caused by the tariffs could lead businesses to delay investment and spending.

Potential Positive Outcomes:

• Negotiation opportunities: President Trump has indicated a willingness to negotiate, which might result in the scaling back of the most severe tariffs.

• Central Banks' response: Central Banks are likely to cut rates at a faster pace if economic growth falters.

• Implementation challenges: Implementing tariffs is more complex than announcing them, which might limit their impact.

• Winners and losers: Tariffs will create both winners and losers in the market.

Investment Considerations:

• Diversified portfolios: Building diversified portfolios exposed to multiple themes can help manage risk.

• Actively managed funds: These funds have the flexibility to move to areas that can generate the best long-term returns.

• Remaining invested: It is crucial to stay invested during periods of market stress, as the biggest rises often follow the largest falls.

In summary, while the announcements are unhelpful and have caused immediate market stress, there are potential positive outcomes and strategies to navigate this period. Staying calm and focusing on the bigger picture is essential during such times. It is also a sharp reminder of why it is vital to have a diversified portfolio of assets within your pension or investment plan.

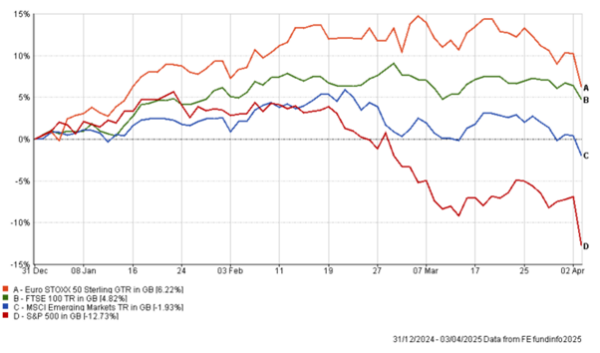

For the past decade or more, the US has consistently been the best performing market. However, recently, we have grown concerned about its valuation compared to other global markets. As a result, our portfolios include a diverse range of global investments. The graph below illustrates key market performance since the beginning of this year, highlighting that the US market has been the worst performer.

Our base case is that things will have calmed down by the end of the year and some rationality and common sense will resume, which in turn would be positive for markets. As ever, periods like this are unnerving but remaining calm, and avoiding snap decisions based on short-term noise is always the sensible approach.

If you have any specific questions or need further insights, please do not hesitate to contact your adviser.

Kind Regards,

The FSWM Team