Welcome to the ADVISORY PORTFOLIO MANAGEMENT (apm) WINTER 2024 Quarterly Review.

The Advisory Portfolio Management (APM) Quarterly Review provides clients within the service a review of the financial world over the last three months, and how this may have affected their pension or investment. If you would like to read more about this service, please Click Here.

A key part of the reporting is the colour coding. Each APM portfolio is colour coded to enable you to spot which category applies to you. The relevant information is then presented in a clear and easy to understand way. However, if you require any further clarification, please do not hesitate to get in touch.

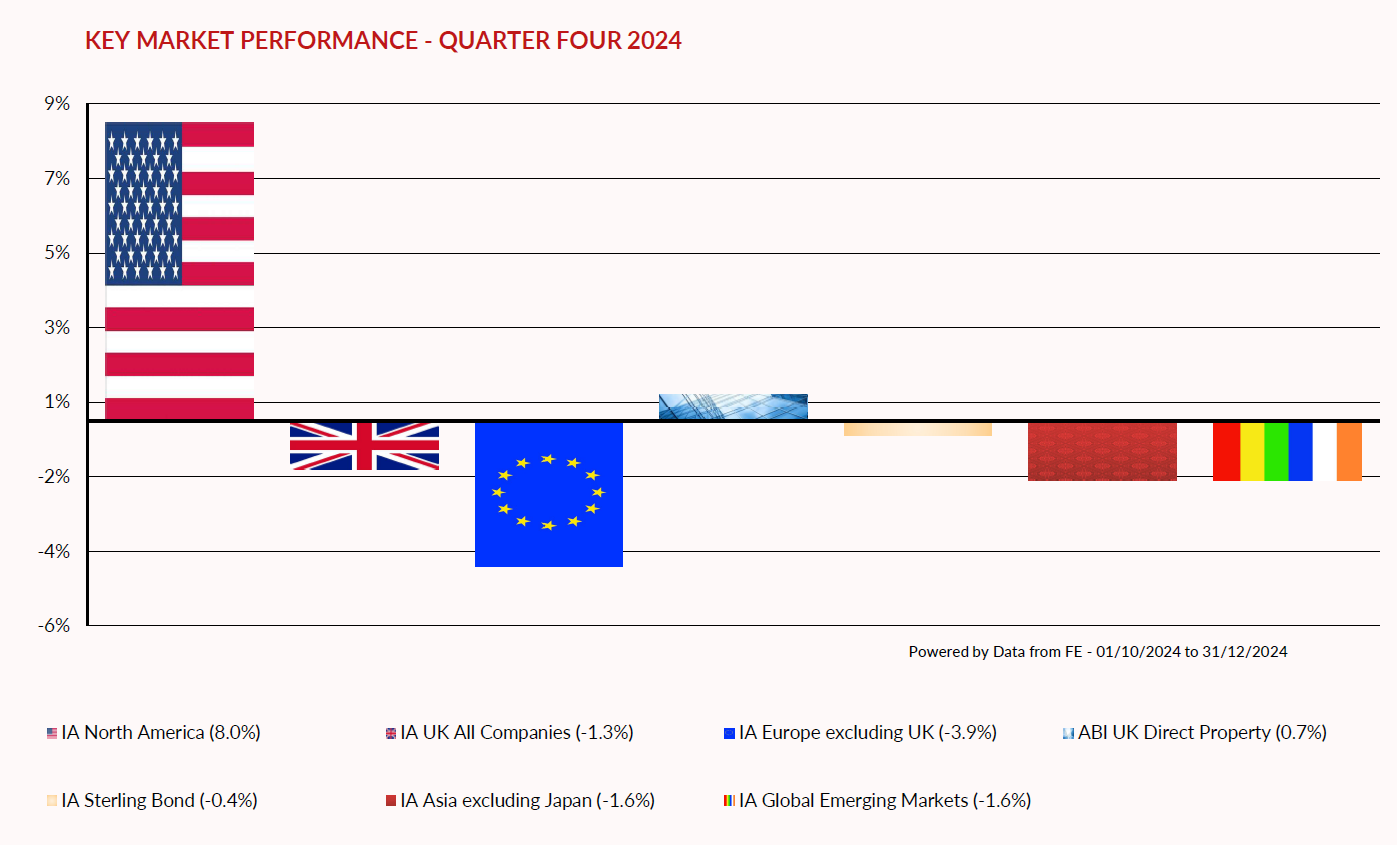

MARKET OVERVIEW - QUARTER FOUR 2024

The narrative for the fourth quarter was dominated by the US election and, whilst a victory for Donald Trump was not a surprise result, the extent to which he won by was. It finished up being way more convincing than polls had indicated, giving him a majority in the House of Representatives and the Senate. This saw equities push upwards led by the so called magnificent 7 as a belief that lower taxes and less regulation would combine to support equities. As the quarter progressed however, the rally began to fade and the much-lauded Santa Claus rally failed to materialise, as the focus moved to concerns around the potential for some of the less supportive policies to weigh on markets.

As we head into 2025, a number of factors are likely to influence the direction of markets. Number one will be how serious the new US president is on implementing some of his more extreme policies. Widescale tariffs would have a detrimental effect on global trade and push up inflation and significant deportation of illegal immigrants would unbalance the labour market and cause wage inflation to accelerate. Significant tax cuts would, on one hand, support corporate profitability and consumer spending, but would also increase US debt which is already running at record levels. The key question is how much of this is rhetoric and how much will be pushed through. History suggests that Donald Trump often uses threats to improve his bargaining position, and we may once again be witnessing this first hand. Second on the list will be the inflationary picture, with the slowdown we have seen over the past 18 months stalling somewhat, and inflations direction of travel will have a major bearing on the extent of any interest rate cuts. Thirdly, politics is also likely to pay its part as France, Germany and Canada amongst others have seen political gridlock, as more parties with more radical policies have seized the initiative.

We remain of the belief that despite headwinds, reasonable corporate profit growth and gently falling interest rates will ultimately lead markets higher. It may however be a year where the ride could be turbulent.

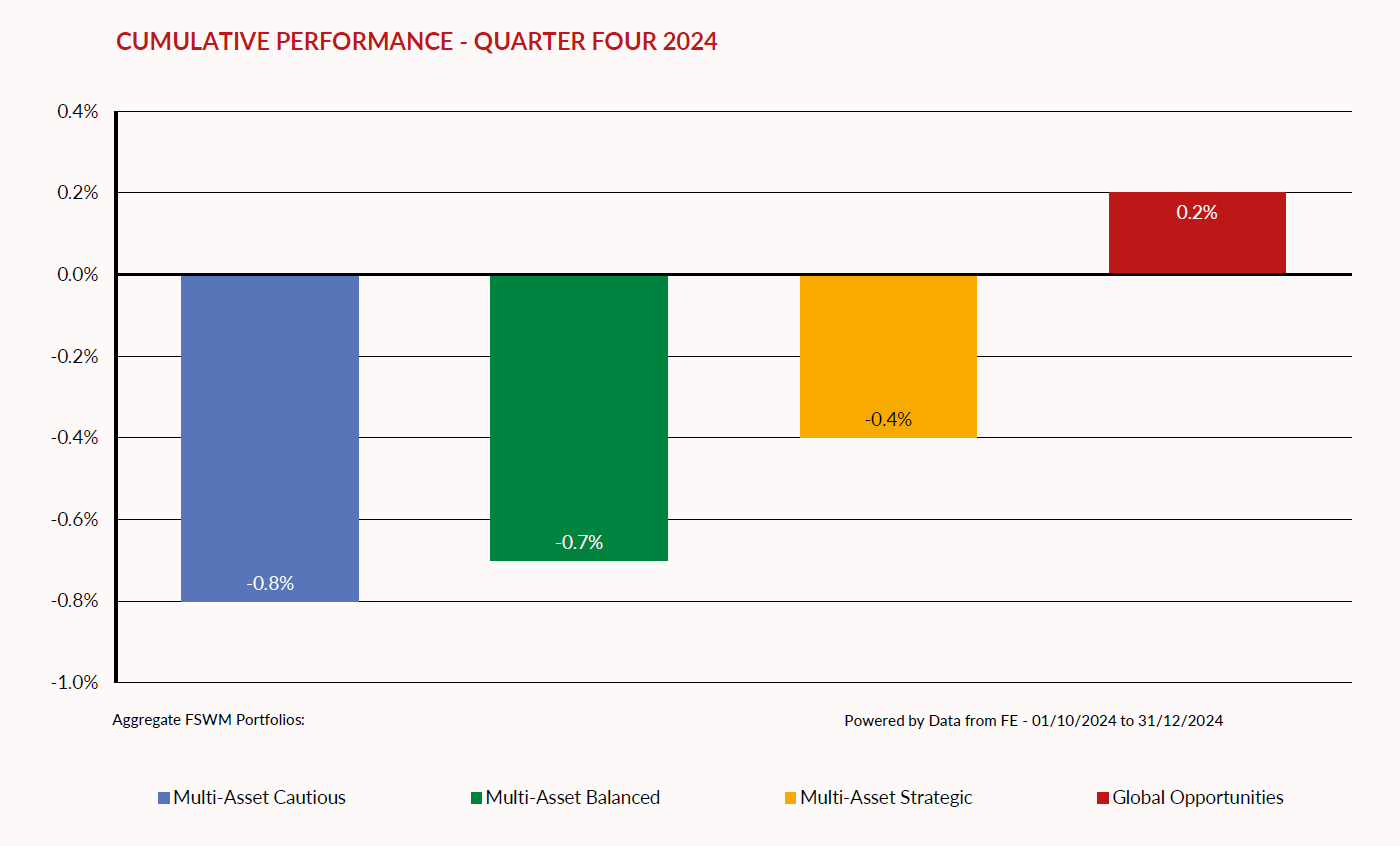

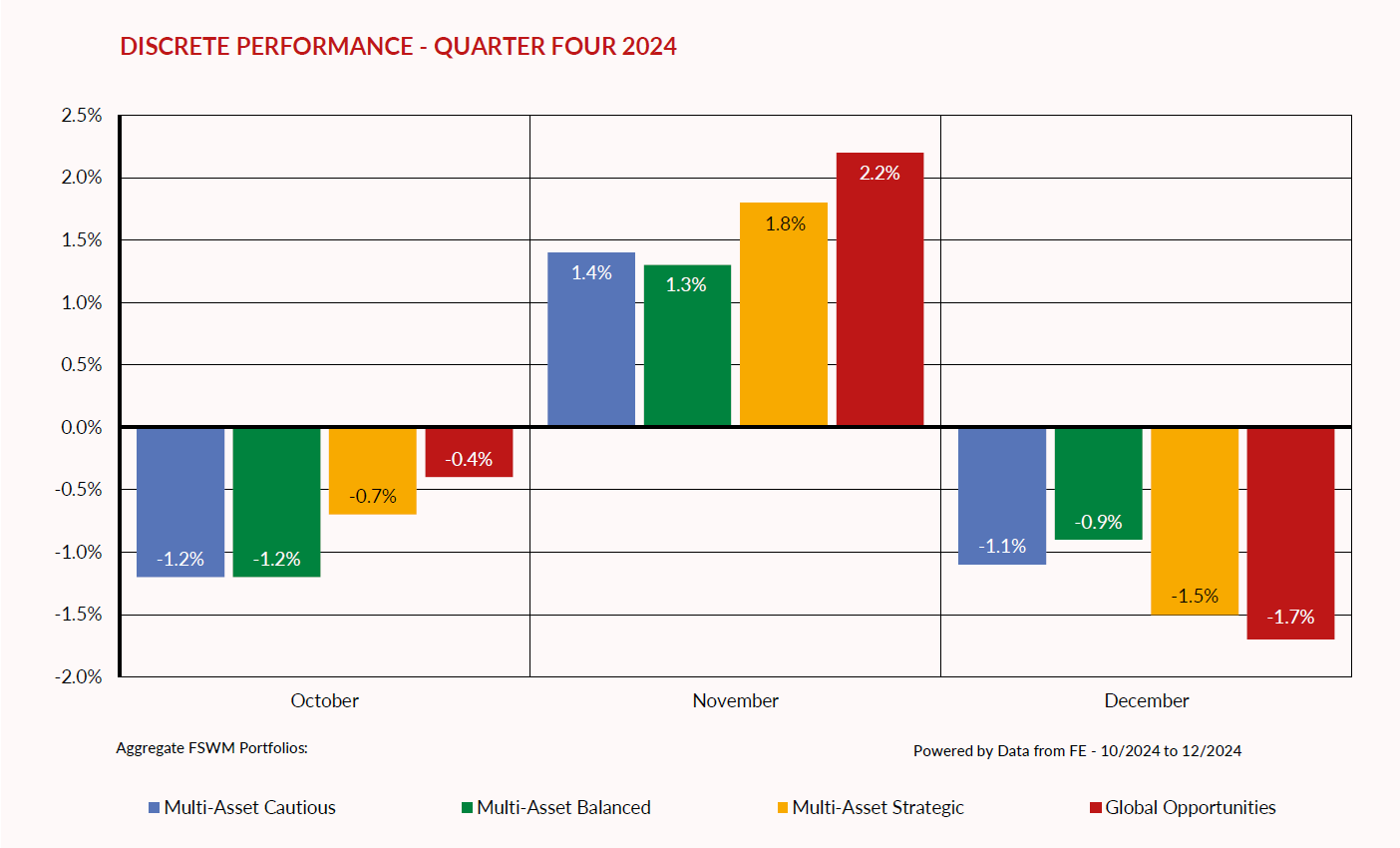

APM PORTFOLIOS - QUARTER FOUR 2024 PERFORMANCE

The graphs below show how the APM portfolios within the four Finance Shop risk categories have behaved over the last three months. The first graph shows the total return for the quarter whereas the second graph illustrates the “month by month” performance. The performance figures are aggregated so, for example, the green bar is made up of all the APM Multi-Asset Balanced portfolios across all product types.

If you require specific performance figures for your plan, please contact your adviser.

PERFORMANCE REVIEW

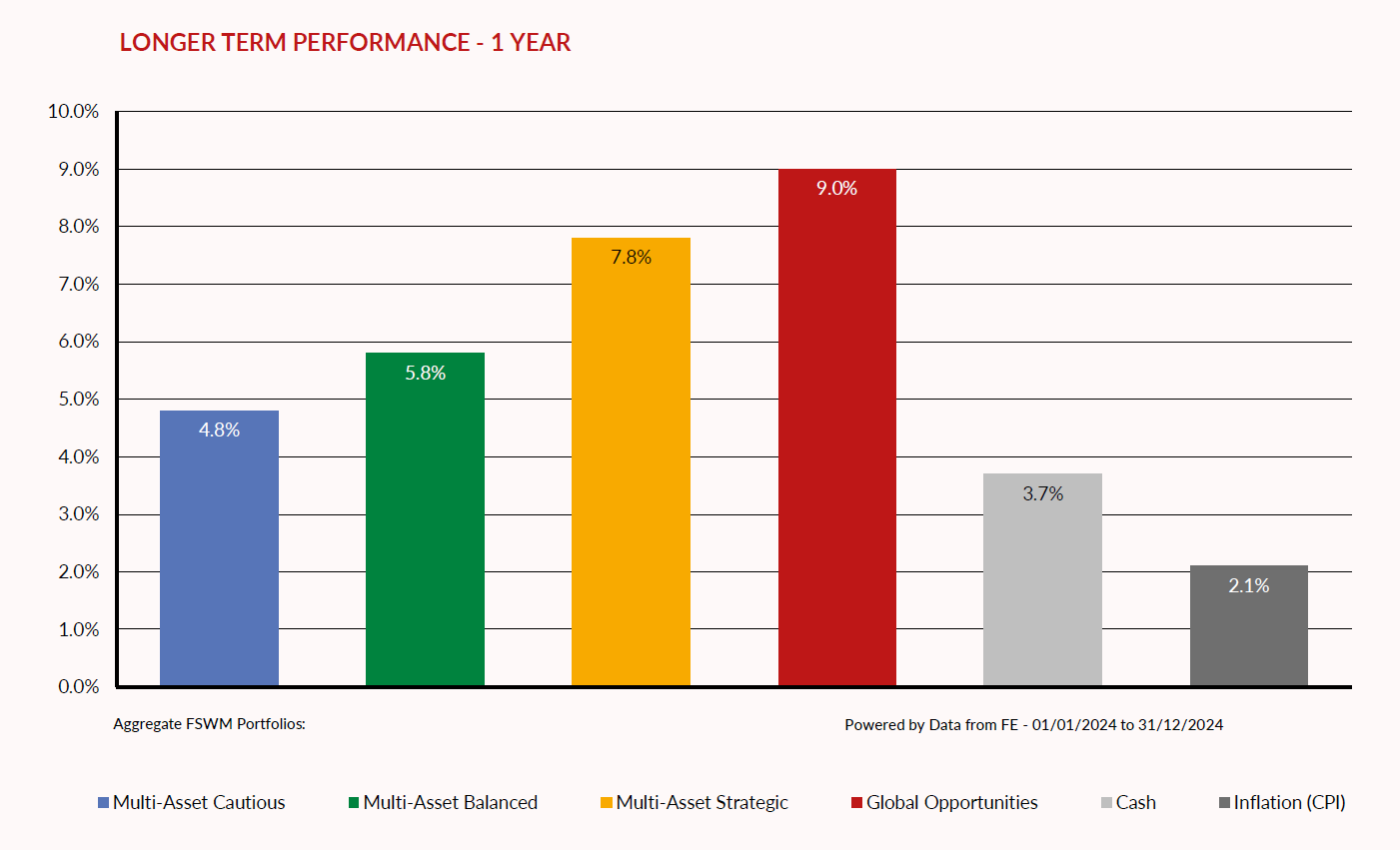

The more subdued final month saw portfolios ultimately unable to hang on to gains with only the most adventurous giving a positive return. That said, all of the portfolios delivered solid annual returns ranging from mid-single digit for the most cautious to high single digit for the most adventurous. We suffered somewhat from a lower exposure to the technology heavyweights, but remain of the belief that valuations look extended and patience will be rewarded.

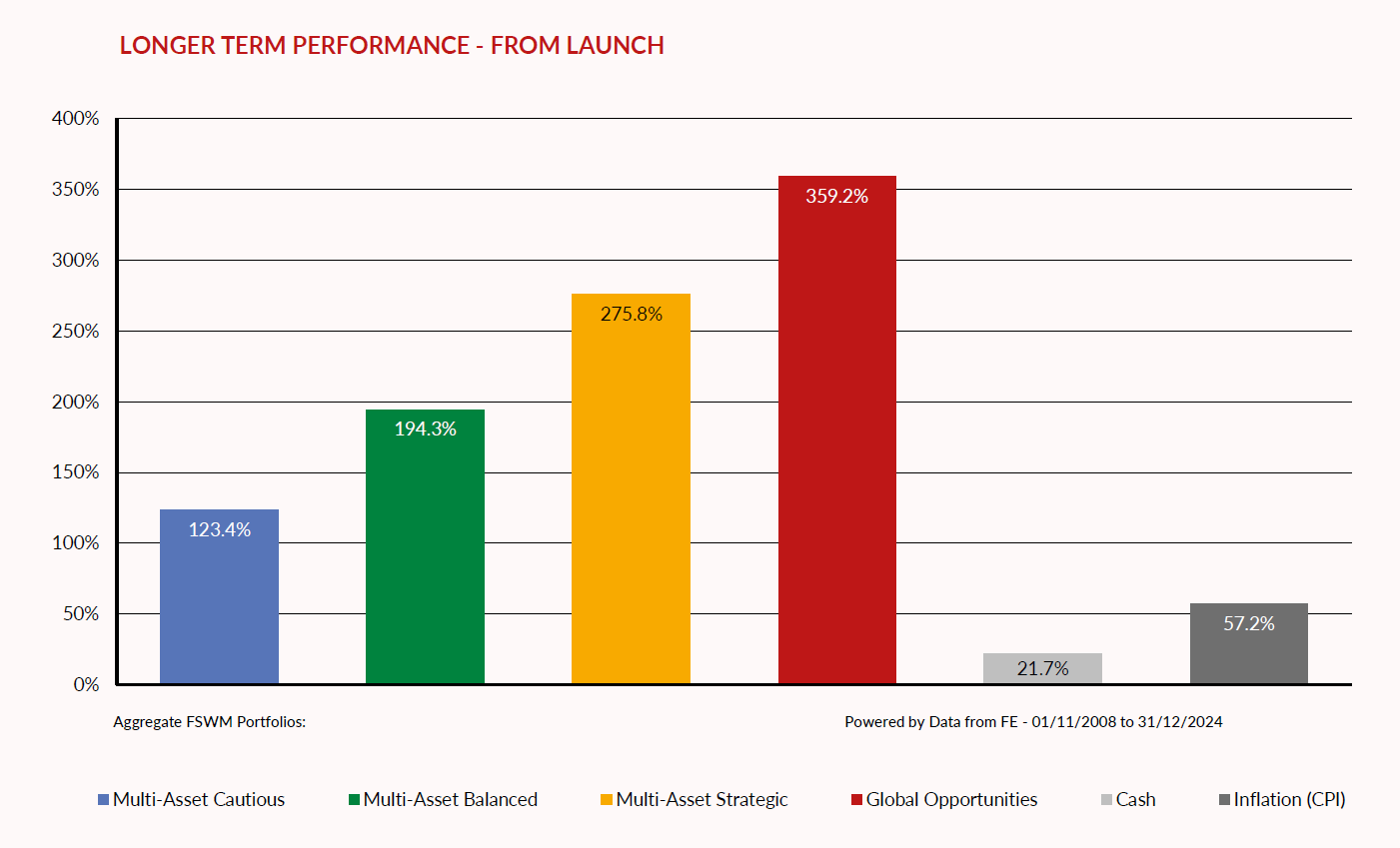

APM PORTFOLIOS - LONGER TERM PERFORMANCE

The first graph below shows how the APM portfolios have performed over 12 months. For comparison, the returns of cash (MoneyFacts 90 days’ notice 10K) and inflation (UK Consumer Price Index) are also shown. The second graph illustrates how the portfolios have performed since launch (1st November 2008).

As with the graphs on the previous page, the figures for each category are aggregated.

APM FUND REVIEW POLICY

A key part of the APM service is to monitor the underlying performance of each fund within the portfolios for both risk and return. We have selected quality funds with strong track records and therefore do not envisage a high turnover of holdings.

However, there will be occasions when the performance of an individual fund will lead to its expulsion from the portfolio(s). There are several factors that determine this decision, for example consistent under-performance, change of management team etc. It is also important, however, to have patience with a fund that is just suffering short-term under-performance.

We operate a “traffic light” system and will move a fund from a “green” to “amber” rating if the fund requires closer scrutiny at the next review. If a fund shows sufficient improvement, it will move back to “green”.

If the fund consistently under-performs without good reason its status will change to “red” and the fund will be removed from the portfolio(s). A replacement fund will be selected and all clients holding the fund within their portfolio will be notified. Upon receipt of their authority, the client’s funds will be switched accordingly.

RESULTS OF FUND & ASSET ALLOCATION REVIEW

The Investment Committee meets on a quarterly basis and one of its primary functions is to review our existing fund range.

Within this meeting we scrutinise any funds which we feel are performing significantly differently to their peer group or benchmark, with a number then run against our internal performance and risk measurements.

The funds under review are as follows:

- Atlantic House Balanced Return Fund

- Gravis UK Infrastructure Income Fund

- Invesco European Equity Fund

- JP Morgan Emerging Markets Equity Fund

- Jupiter European Fund

- Liontrust Special Situations Fund

- Matthews Asia Discovery Fund

- Regnan Global Impact Solutions Fund

ADDITIONAL IMPORTANT INFORMATION

This report has been issued by the Investment Committee of the Finance Shop Wealth Management team using data provided by Financial Express. Care has been taken to ensure that the information is correct but Financial Express and Finance Shop neither warrants, represents nor guarantees the contents of the information, nor does Financial Express or Finance Shop accept any responsibility for errors, inaccuracies, omissions, or any inconsistencies herein.

Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Currency fluctuations can also affect fund values. The above report does not constitute advice and you should speak to your Independent Financial Adviser before you make any alterations to investments or pension plans.

The instruments recorded above are weighted model portfolios created using Financial Express Analytics. Performance figures shown are based on the weighted models and may differ from the actual returns achieved by investors. Performance figures shown are based on bid-to-bid gross returns and do not include plan, contract, or ongoing adviser charges / commission. Please refer to your policy documentation for further details.

ABOUT FINANCE SHOP

Finance Shop is a trading name of Finance Shop Limited. Company Number 07535053. Registered in England. Registered Office: North Wood Place, Octagon Business Park, Little Plumstead, Norwich, Norfolk NR13 5FH. Finance Shop is authorised and regulated by the Financial Conduct Authority.