Welcome to the ADVISORY PORTFOLIO MANAGEMENT (apm) AUTUMN 2024 Quarterly Review.

The Advisory Portfolio Management (APM) Quarterly Review provides clients within the service a review of the financial world over the last three months, and how this may have affected their pension or investment. If you would like to read more about this service, please Click Here.

A key part of the reporting is the colour coding. Each APM portfolio is colour coded to enable you to spot which category applies to you. The relevant information is then presented in a clear and easy to understand way. However, if you require any further clarification, please do not hesitate to get in touch.

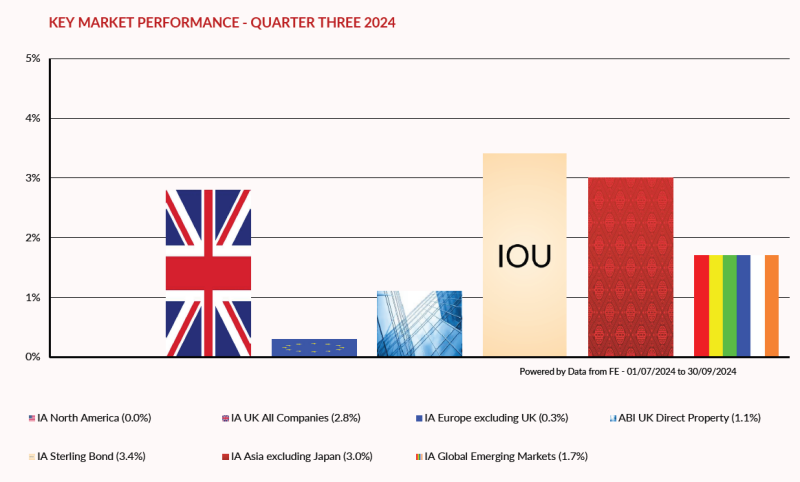

MARKET OVERVIEW - QUARTER THREE 2024

The third quarter saw markets continue to deliver solid gains, with most asset classes providing positive returns, but underneath the headlines we witnessed some significant movement. After a quiet July, things exploded into life as a combination of a subtle change in direction by the Japanese central bank, increasing rates for the first time for a generation, and poorly received employment data in the US caused the so-called carry trade to unwind. The carry trade is where investors sell currencies with a low interest rate, such as the Japanese Yen, and use the money to reinvest into areas with a higher rate of return, in many cases US technology shares. This unwind saw the Japanese market drop by 10% in a day, and technology shares in the US take a pounding. The situation was also a victim of timing, August being a period where volumes are generally light due to summer holidays, which can often exaggerate movements. As has often been the case the pull back was short lived, as the promise of easing policy from central banks and more robust data calmed nerves.

As the quarter progressed, we saw further central banks finally delivering the promise of rate cuts with the Bank of England reducing by 0.25% in August and then the Federal Reserve in the US surprising markets with a bigger than expected cut of 0.5% in September. Markets were impressed and looser financial conditions encouraged investors to put money to work, and boost indices. Sentiment was further helped by a raft of stimulus measures announced by the People’s Bank of China. Growth in China is threatening to under shoot its target, and the property market remains in crisis, undermining consumers appetite to spend. This really is a large package of measures and not before time, but the question remains if it can address some of the structural issues impacting the wider Chinese economy. So far the market likes what it has seen, but time will tell if this proves enough.

Looking ahead to the final quarter, we may well see increased volatility, as the ramp up in tensions around the Middle East and the conclusion of the US election campaign, provide potential pinch points. That said, providing things don’t deteriorate significantly, the prospect of further rate cuts should provide sufficient support to see markets rally into the year end.

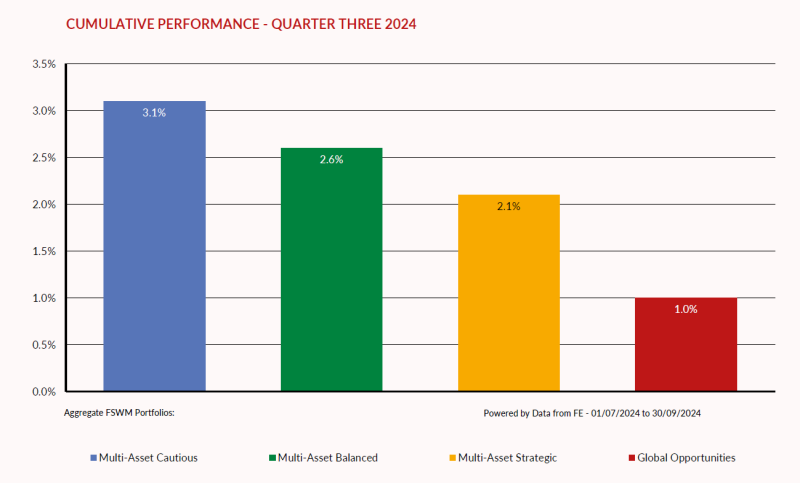

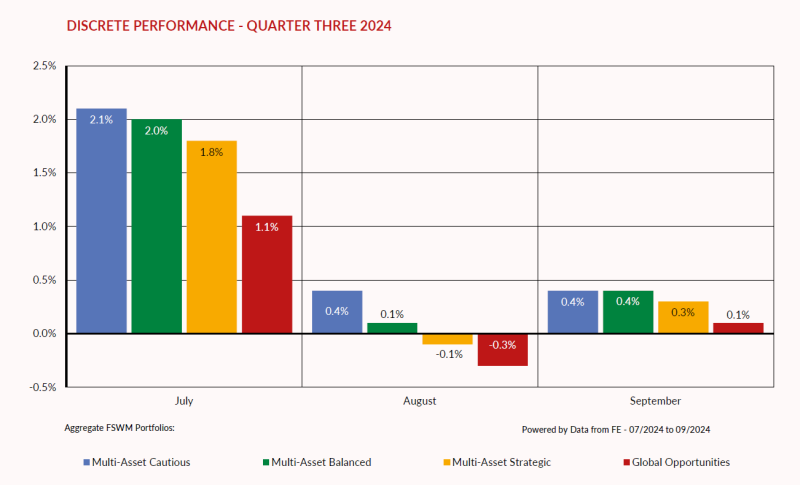

APM PORTFOLIOS - QUARTER THREE 2024

The graphs below show how the APM portfolios within the four Finance Shop risk categories have behaved over the last three months. The first graph shows the total return for the quarter whereas the second graph illustrates the “month by month” performance. The performance figures are aggregated so, for example, the green bar is made up of all the APM Multi-Asset Balanced portfolios across all product types.

If you require specific performance figures for your plan, please contact your adviser.

PERFORMANCE REVIEW

All the portfolios enjoyed positive returns over the quarter, pushed upwards by central banks cutting interest rates. It was, however, the more cautious portfolios which led returns, as the culmination of rate cuts and the promise of more to come, boosted returns across the fixed income spectrum.

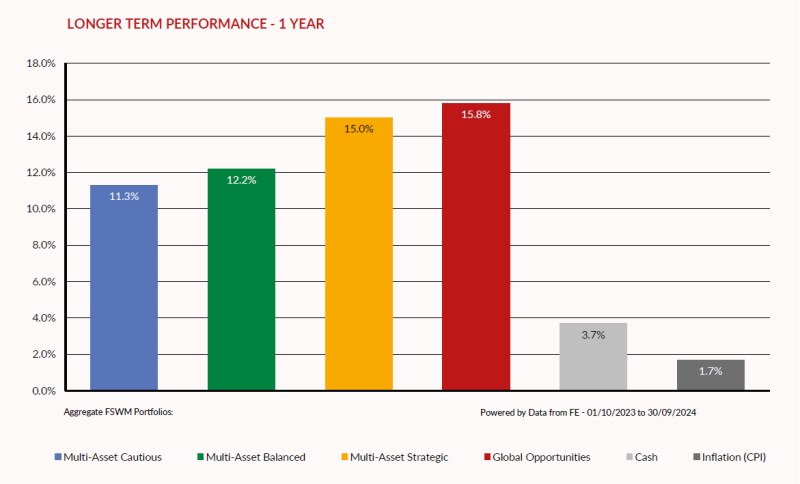

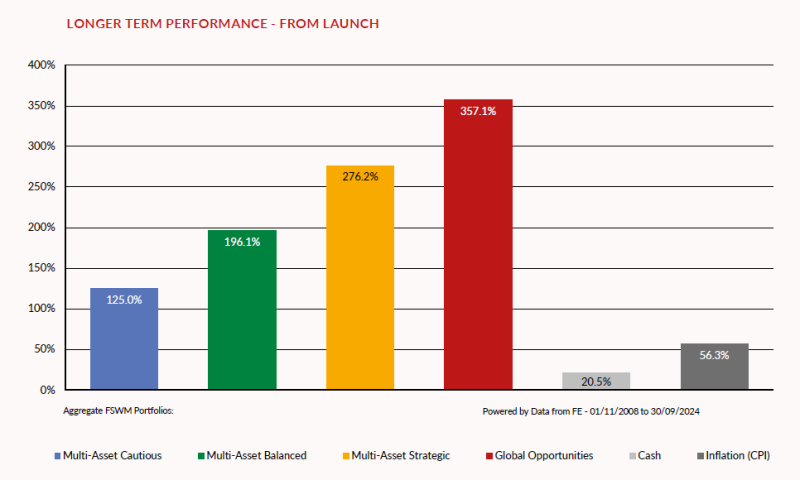

APM PORTFOLIOS - LONGER TERM PERFORMANCE

The first graph below shows how the APM portfolios have performed over 12 months. For comparison, the returns of cash (MoneyFacts 90 days’ notice 10K) and inflation (UK Consumer Price Index) are also shown. The second graph illustrates how the portfolios have performed since launch (1st November 2008).

As with the Cumulative & Discrete Performance graphs, the figures for each category are aggregated.

APM FUND REVIEW POLICY

A key part of the APM service is to monitor the underlying performance of each fund within the portfolios for both risk and return. We have selected quality funds with strong track records and therefore do not envisage a high turnover of holdings.

However, there will be occasions when the performance of an individual fund will lead to its expulsion from the portfolio(s). There are several factors that determine this decision, for example consistent under-performance, change of management team etc. It is also important, however, to have patience with a fund that is just suffering short-term under-performance.

We operate a “traffic light” system and will move a fund from a “green” to “amber” rating if the fund requires closer scrutiny at the next review. If a fund shows sufficient improvement, it will move back to “green”.

If the fund consistently under-performs without good reason its status will change to “red” and the fund will be removed from the portfolio(s). A replacement fund will be selected and all clients holding the fund within their portfolio will be notified. Upon receipt of their authority, the client’s funds will be switched accordingly.

RESULTS OF FUND & ASSET ALLOCATION REVIEW

The Investment Committee meets on a quarterly basis and one of its primary functions is to review our existing fund range.

Within this meeting we scrutinise any funds which we feel are performing significantly differently to their peer group or benchmark, with a number then run against our internal performance and risk measurements.

The funds under review are as follows:

· Atlantic House Balanced Return Fund

· Gravis UK Infrastructure Income Fund

· Invesco European Equity Fund

· JP Morgan Emerging Markets Equity Fund

· Jupiter European Fund

· Liontrust Special Situations Fund

· Matthews Asia Discovery Fund

· Regnan Global Impact Solutions Fund

ADDITIONAL IMPORTANT INFORMATION

This report has been issued by the Investment Committee of the Finance Shop Wealth Management team using data provided by Financial Express. Care has been taken to ensure that the information is correct but Financial Express and Finance Shop neither warrants, represents nor guarantees the contents of the information, nor does Financial Express or Finance Shop accept any responsibility for errors, inaccuracies, omissions, or any inconsistencies herein.

Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Currency fluctuations can also affect fund values. The above report does not constitute advice and you should speak to your Independent Financial Adviser before you make any alterations to investments or pension plans.

The instruments recorded above are weighted model portfolios created using Financial Express Analytics. Performance figures shown are based on the weighted models and may differ from the actual returns achieved by investors. Performance figures shown are based on bid-to-bid gross returns and do not include plan, contract, or ongoing adviser charges / commission. Please refer to your policy documentation for further details.