Welcome to the Summer 2018 Finance Shop Wealth Management (FSWM) Quarterly Review.

The Finance Shop Quarterly Review provides clients in our Advisory Portfolio Management (APM) service a review of the financial world over the last three months, and how this may have affected their pension or investment. If you would like to read more about this service, please Click Here.

A key part of the reporting is the colour coding. Each FSWM portfolio is colour coded to enable you to spot which category applies to you. The relevant information is then presented in a clear and easy to understand way. However, if you require any further clarification, please do not hesitate to get in touch.

MARKET OVERVIEW - QUARTER TWO 2018

The second quarter saw a mixed bag of returns as worries over an escalation in the trade war between the US and China hurt countries in Asia, whilst domestic investors benefited from a fall in Sterling. The investment landscape remains very complicated as markets try to establish the strength of global growth and the extent to which inflation will rebound. This is important as it will determine the direction and degree to which interest rates will move, and the threat of a trade war only complicates matters further.

This backdrop led to many Asian countries suffering falls as they are perceived to be at the greatest risk should trade war concerns intensify. Also in the firing line were many emerging countries impacted by a rising dollar which often increases the cost of servicing debt, whilst in Europe underperformance was driven by concerns over the strength of growth. In the UK, conversely, markets fared better as bid activity and a fall in Sterling supported markets, whilst the US benefited from its safe haven status and being less exposed to the impact of trade tariffs.

Looking ahead it appears likely that the more volatile backdrop continues and whilst the likelihood of a damaging trade war has increased somewhat, our central scenario remains that things will eventually calm down. This should help improve sentiment and allow investors to focus on a supportive backdrop.

FSWM PORTFOLIOS – ASSET ALLOCATION

There are seven portfolios in the FSWM range, four growth and three income which are detailed below. Your FSWM pension or investment will be invested in one of these categories. The tables show the aggregate composition of the portfolios with some figures to show the potential risk and return of each category.

GROWTH PORTFOLIOS

INCOME PORTFOLIOS

There are three income portfolios which aim to produce an income within a target range as highlighted in the table below. The three portfolios cover the Cautious, Balanced and Adventurous Finance Shop risk categories.

FSWM PORTFOLIOS – QUARTER TWO 2018 PERFORMANCE

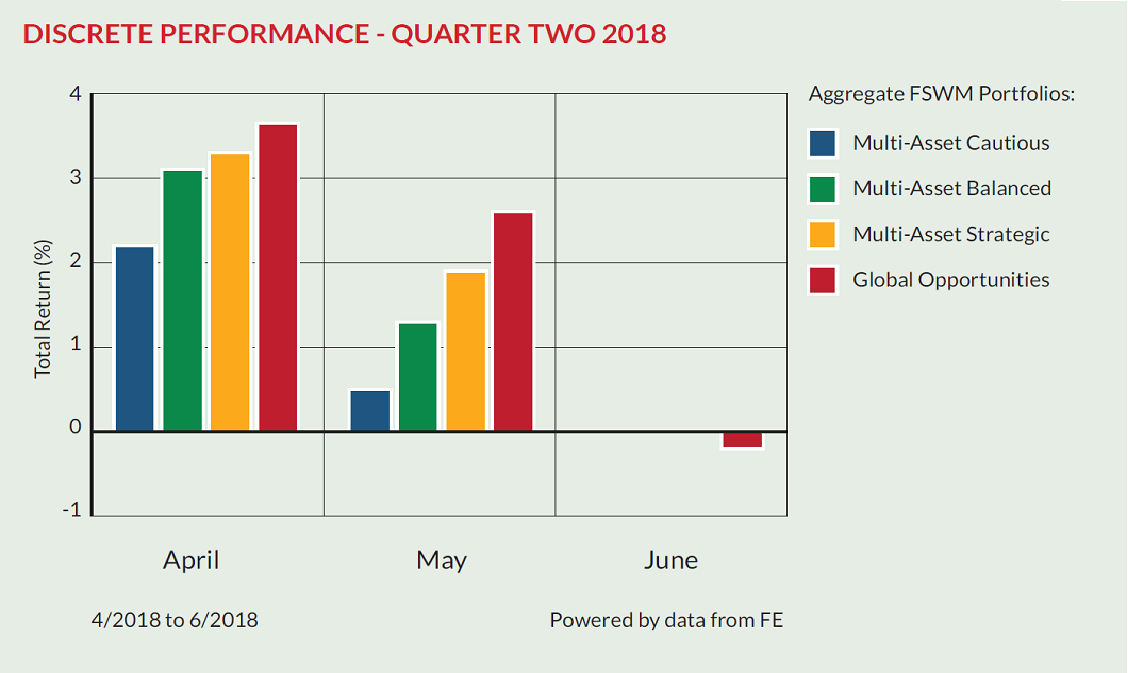

The graphs below show how the FSWM portfolios within the four Finance Shop risk categories have behaved over the last three months. The first graph shows the total return for the quarter whereas the second graph illustrates the "month by month" performance. The performance figures are aggregated so, for example, the green bar is made up of all the FSWM Multi-Asset Balanced portfolios across all product types. If you require specific performance figures for your plan, please contact your adviser.

FSWM PORTFOLIOS – LONGER TERM PERFORMANCE

The first graph below shows how the FSWM portfolios have performed over 12 months. For comparison, the returns of cash (MoneyFacts 90 days notice 10K) and inflation (UK Consumer Price Index) are also shown. As with the graphs on page 6, the figures for each category are aggregated.

The second graph illustrates how the portfolios have performed since launch (1st November 2008).

PERFORMANCE REVIEW

It was pleasing to see all the portfolios recover, following a difficult first quarter, with Global Opportunities leading the way. We would envisage that the second half of 2018 continues to reflect the more challenging environment and that markets will remain volatile. That said, we continue to believe that equities will outperform other asset classes.

FSWM FUND REVIEW POLICY

A key part of the FSWM service is to monitor the underlying performance of each fund within the portfolios for both risk and return. We have selected quality funds with strong track records and therefore do not envisage a high turnover of holdings. However, there will be occasions when the performance of an individual fund will lead to its expulsion from the portfolio(s). There are a number of factors that determine this decision, for example consistent under-performance, change of management team etc. It is also important, however, to have patience with a fund that is just suffering short-term under-performance.

We operate a "traffic light" system and will move a fund from a "green" to "amber" rating if the fund requires closer scrutiny at the next review. If a fund shows sufficient improvement, it will move back to "green". If the fund consistently under-performs without good reason its status will change to "red" and the fund will be removed from the portfolio(s). A replacement fund will be selected and all clients holding the fund within their portfolio will be notified. Upon receipt of their authority, the client’s funds will be switched accordingly.

RESULTS OF FUND & ASSET ALLOCATION REVIEW

The Investment Committee meets on a bi-monthly basis and one of its primary functions is to review our existing fund range.

Within this meeting we scrutinise any funds which we feel are performing significantly differently to their peer group or benchmark, with a number then run against our internal performance and risk measurements.

There were several changes to the funds under review, with JP Morgan Multi-Asset Income, Blackrock Continental European Income and Aviva Multi-Strategy Growth being added and Janus Henderson Cautious Managed and Newton Global Income being removed, leaving the following funds under review:

- Aviva Multi-Strategy Growth

- Blackrock Continental European Income

- Fidelity Moneybuilder Dividend

- Fidelity Enhanced Income

- JP Morgan Multi-Asset Income

- Invesco Perpetual Distribution

- Invesco Perpetual Income

- M&G Global Macro

ASSET ALLOCATION TABLE PAGES FOUR AND FIVE –IMPORTANT INFORMATION

The maximum quarterly gain and loss figures in the asset allocation tables on pages 4 & 5 are taken from Financial Express based on the last 36 quarters of the longest running FSWM portfolios (up to February 2018). For the table on page 5, the figures are based on 18 quarters.

FE Risk Score: Financial Express have introduced FE Risk Scores to provide a single, easy to understand measure of risk across a range of investments. In the UK, Risk Scores measure the riskiness of any given investment in relation to the FTSE 100. Weekly volatility is measured over up to 3 years, with recent behaviour counting more heavily than earlier behaviour. The Risk Score is calculated weekly, and can be tracked over time. Cash type investments will have scores near zero, investment funds will tend to have scores in the 0 - 150 range.

The FTSE 100 is always 100. There is no upper limit to the scores.

The asset allocation figures on pages 4 and 5 are aggregated based on the current holdings within the FSWM portfolios for a new investor as at 2nd February 2018. They will vary on a daily basis subject to market fluctuations. Rebalancing will be recommended if equity content exceeds the benchmark maximums. There is no guarantee that any of the model portfolios above will achieve their stated objectives. Each model portfolio may also experience more or less volatility than expected. The value of investments will fall as well as rise and are not guaranteed. Past performance is no guide to future performance. The Finance Shop Risk Categories are graded from 1 to 7. The above portfolios cover categories 3 to 6. For further information on all categories, please speak to your Finance Shop Independent Financial Adviser.

ADDITIONAL IMPORTANT INFORMATION

This report has been issued by the Investment Committee of the Finance Shop Wealth Management team using data provided by Financial Express. Care has been taken to ensure that the information is correct but Financial Express and Finance Shop neither warrants, represents nor guarantees the contents of the information, nor does Financial Express or Finance Shop accept any responsibility for errors, inaccuracies, omissions or any inconsistencies herein.

Past performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amount originally invested. Currency fluctuations can also affect fund values. The above report does not constitute advice and you should speak to your Independent Financial Adviser before you make any alterations to investments or pension plans.

The instruments recorded above are weighted model portfolios created using Financial Express Analytics. Performance figures shown are based on the weighted models and may differ from the actual returns achieved by investors. Performance figures shown are based on bid to bid gross returns and do not include plan, contract or ongoing adviser charges / commission. Please refer to your policy documentation for further details.

Financial Express Limited Registration number: 2405213. Registered office: 7 Chertsey Road, Woking, Surrey, GU21 5AB. Telephone 01483 783 900. Website www.financialexpress.net

Finance Shop is a trading name of Finance Shop Limited. Company Number 07535053. Registered in England. Registered Office: North Wood Place, Octagon Business Park, Little Plumstead, Norwich, Norfolk NR13 5FH.

Finance Shop is authorised and regulated by the Financial Conduct Authority.

ABOUT FINANCE SHOP

Formed in 1990, Finance Shop has grown to become one of the region’s leading firms of Independent Financial Advisers.

As a locally owned, genuinely independent company, we pride ourselves on the quality of our advice and service to both personal and corporate clients. With over 150 years of financial services experience within the firm and over half a billion of assets under management, we have the expertise, experience and knowledge to be able to advise on all aspects of financial planning.

Our belief is that access to quality, independent advice is more important than ever and that is why we spend the majority of our time face to face with new and existing clients, explaining the key issues of today and helping them plan for the future.